Key Takeaways:

• Next year Sales target of PKR 5bn

• Two new stores to open at Faisalabad and Sialkot

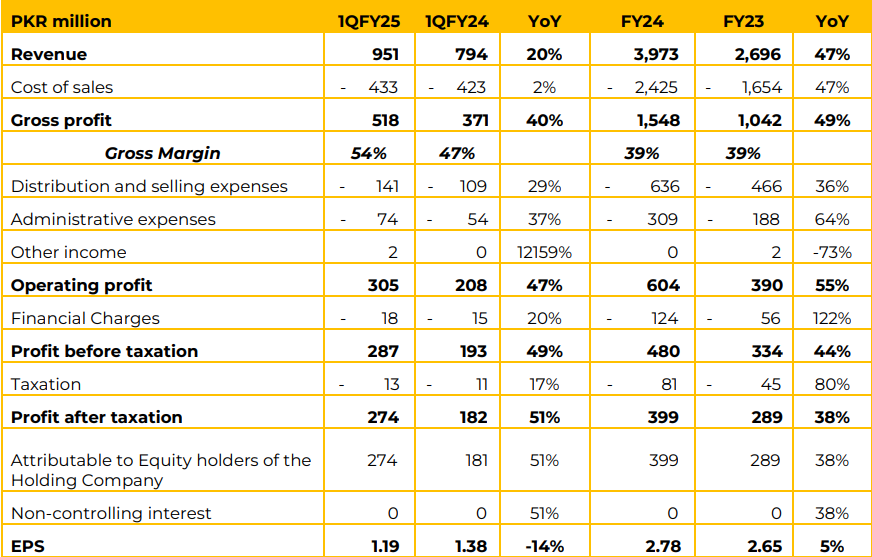

On consolidated bases, the revenue increased by 20% in 1QFY25, reaching PKR 951mn compared to PKR 794mnn in 1QFY24. For FY24 revenue rose by 47% YoY, from PKR 2,696mn in FY23 to PKR 3,973mn.

Cost of sales saw a 2% YoY increase in 1QFY25, amounting to PKR 433mn, up from PKR 423mn in 1QFY24. On an annual basis, FY24 cost of sales grew by 47%, reaching PKR 2,425mn compared to PKR 1,654mn in FY23. The gross margin in 1QFY25 was 54%, up from 47% in 1QFY24, indicating an improved profitability ratio in the quarter.

However, on an annual basis, the gross margin remained stable at 39% in both FY24 and FY23, showing consistent cost control over the fiscal year. Distribution and selling expenses in 1QFY25 were PKR 141mn, a 29% increase from PKR 109mn in 1QFY24. For FY24 these expenses rose by 64% from PKR 188mn in FY23 to PKR 309mn in FY24, due to expanded sales activities and marketing efforts. Administrative expenses in 1QFY25 reached PKR 7mn, up 37% YoY from PKR 54mn in 1QFY24. In FY24, these expenses increased by 44% from PKR 654mn in FY23 to PKR 945mn in FY24, likely due to inflationary pressures and business growth.

Profit after taxation for 1QFY25 rose by 51% YoY to PKR 274mn from PKR 182mn in 1QFY24. On an annual basis, profit after tax grew by 38%, increasing to PKR 399mn in FY24 from PKR 289mn in FY23.

The management noted that they have acquired Image Global Limited to run their domestic and export ecommerce sales, in order to benefit from the tax exemptions for ecommerce platforms as they are classified as IT companies.

The management admits that the inventory holding period is long and they are trying to bring it down to 90 or less days. However, they explained that the acquisition of raw material, processing, packing, delivery to stores and sales takes time, but they are keen to improve this initially targeting a range of 90-100 days.

Most of the advertising budget of the company runs in the 4 th quarter. Since the peak selling season starts from MidFebruary starting from Ramzan – Muharram, the marketing expenditures done in the last quarter have a spill-out effect that lasts through-out the year.

The shooting of lawn and international shoot takes place in this quarter. They further mentioned that 1 st and 2nd quarter of the fiscal year are not ideal for selling fabric items be it lose fabric or ready-made due to certain weather conditions in Pakistan. Fog and Smog cause earlier closure of markets in the upper regions, thereby impacting sales during this season. However, as soon as February starts the sales start to pick-up lasting till the start of Muharram. Image’s store at Dolmen Mall, Lahore is expected to be opened on 22nd November 2024, ideally on the first day of the opening of the new mall. They also mentioned that the Tipu Sultan, Karachi store is the second best-selling store after Dolmen Mall, Karachi.

Going forward, the management is targeting Sales of PKR 5bn. The company is going to establish one store in Sialkot and one in Faisalabad. However, they do not plan to open stores aggressively but rationally. The company also plans to launch western clothing for international market. Image envisions to remain a premium brand, focusing on innovation and creativity.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.