Key Takeaways:

● APL Explores EV Charging Infrastructure with Potential Joint Ventures and Direct Investments

● APL Targets OMC Acquisitions to Strengthen Market Position and Eliminate Competition

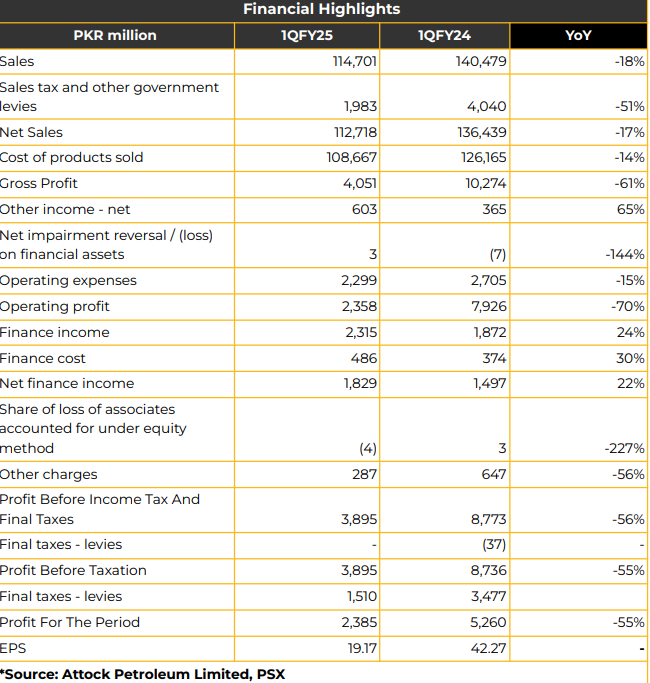

In 1QFY25, Attock Petroleum Limited reported net earnings of PKR 2.38 billion (EPS: PKR 19.17), reflecting a 55% YoY decline from PKR 5.26 billion (EPS: PKR 42.27) in the SPLY.

The decline in profitability was attributed to The company’s revenue decreased by 18% YoY to PKR 114.70 billion, with gross profit down by 61% YoY, totaling PKR 4.05 billion.

Operating expenses declined 15% YoY to PKR 2.30 billion while operating profit declined 70% YoY to PKR 2.36 billion in 1QCY25, primarily due to exchange loss, compared to PKR 7.93 billion in the SPLY. Finance costs increased by 30% YoY to PKR 1.83 billion in 1QCY25, compared to PKR 1.50 billion in the SPLY. Other income increased 65% YoY to PKR 602.575 million in 1QCY25 from PKR 364.98 million in the SPLY.

This increase in other income was attributed to higher mutual fund income and higher rental income. In FY24, APL achieved a net profit of PKR 13.82 billion in FY24, 11% higher than SPLY. Net sales also witnessed a growth of 11% YoY to PKR 526.32 billion in FY24.

Operating profit reached PKR 16.51 billion in FY24. This was attributed to a 20% increase in average selling price. Management highlighted a strong cash position aimed at potential M&A opportunities, likely to acquire another OMC. While a previous bid was unsuccessful, they are actively exploring acquisition targets to strengthen market position and reduce competition.

Management indicated that APL’s strategy of establishing company-owned and operated retail outlets aims to enhance brand identity by delivering consistent, high-quality service.

This approach differentiates APL from competitors who rely on high dealer rebates, which can compress margins. By retaining operational control, APL benefits from stronger brand positioning and customer loyalty, providing a competitive advantage beyond immediate financial gains. Industrial OMC volumes declined by 9% YoY to 15.76 million tons, with APL’s volumes down 8% YoY to 1.61 million tons, attributed to high inflation and decreased economic activity. APL’s storage capacity stood at 210,885 million tons as of June 30, 2024, across nine terminals, and its retail outlets grew to 798. OMC margins for HSD and Premier Motor Gasoline were reported at 7.87% in FY24, with management actively negotiating margin increases to offset inflationary pressures.

OGRA’s proposal to raise OMC margins remains unapproved. APL also reported 94,000 metric tons of jet fuel sales in FY24, representing 50% of the Islamabad market, where it shares a 50% agreement with PSO. In FY24, APL reported shifts in market share, with declines for PSO (down 2% to 48.7%), Shell (down 2% to 7.3%), and GO (down 41% to 3.3%). However, market share rose for TPPL (up 9% to 11%), APL (up 1% to 10.2%), Cynergico (up 40% to 3%), Hascol (up 1% to 2.5%), and other players (up 12% to 13.8%).

Going forward, APL is advancing terminal expansion projects in the North and Port Qasim. Its LPG pilot project, with a sales target of 120 million tons and a capacity of 200 metric tons (expandable to 300 Mt), is expected to be completed by January 2025.

This project aims to focus on industrial and commercial markets. APL’s focus moving forward is on bottom-line improvement over topline growth.

Additionally, the company is exploring EV charging infrastructure, with plans for joint ventures or direct investments. This is subject to a pending EV policy expected to be released in late November.

APL invests PKR 40 million for one EV station. Management reported that APL holds 22 of the 42 motorway locations under the EV policy, securing a 56% market share in motorway EV charging stations. Terminal expansions are expected in the North (post-litigation) and at Port Qasim and Rawalpindi, with estimated capex at PKR 800 million–1 billion for Port Qasim and PKR 600–700 million for Rawalpindi.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.