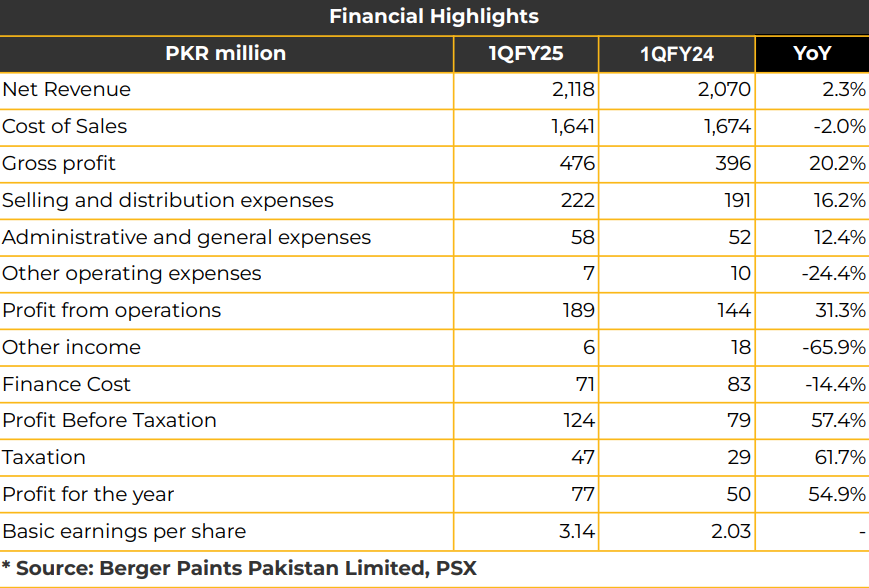

In 1QFY24, Berger Paints Pakistan Limited achieved a net profitability, surging to PKR 77.06 million (EPS: PKR 3.14), 55% YoY up, from the net profit of PKR 49.75 million (EPS: PKR 2.03) in the same period last year.

Volumetric growth and price increases contributed towards this growth. In FY24, the company’s sales increased by 16% YoY, reaching PKR 8.54 billion, with a gross profit increase of 16% YoY amounting to PKR 1.72 billion.

Profit before and after tax increased by 27% YoY and 10% YoY respectively, standing at PKR 421.35 million and PKR 262.86 million in FY24.

Management reported that the organized segment comprises 50% of the total market, with net sales recorded at PKR 75-80 billion in FY24.

The organized sector consists of seven paint companies. BERG primarily exports to Afghanistan, with exports totalling PKR 60 million in FY24.

The export market segment overall stands at PKR 1 billion out of a total market size of PKR 150 billion. BERG’s paint production in Pakistan reached 40 million litres of paint in FY24. Management reported that some raw materials are subject to anti-dumping duties.

The retail segment of BERG, accounting for 45-50% of total value, primarily serves the household market. BERG also announced a cash dividend of 40% and a bonus dividend of 20% in FY23 and FY24 respectively.

Despite challenges faced in FY23, the company effectively managed its inventories in the 1QFY23, overcoming later restrictions in the 2QCY23 without hampering production. The company’s revenue experienced a 2.3% YoY growth, reaching PKR 2.12 billion in 1QFY24, compared to PKR 2.07 billion in the same period of the previous year.

However, the cost of sales also decreased by 2% to PKR 1.64 billion, compared to PKR 1.67 billion in the previous year. During 1QFY24, Berger Paints witnessed a significant growth of 20% YoY in gross profit and a remarkable 31% increase in operating profit. Distribution and administrative expenses rose by 16% and 12% YoY respectively, while other expenses decreased by 24% YoY in 1QCY25.

The finance cost of the company decreased by 14% YoY to PKR 70.86 million, compared to PKR 82.75 million in the previous year. The company’s asset composition included fixed assets (32%), inventories (20%), trade debts & advances (37%), tax refundable (3%), and other assets (8%).

The main sources of funds for the company comprise equity (48%), debt (17%), trade payables (30%), and other sources (5%). Berger Paints Pakistan Limited holds 19% shareholding in Buxly Paints Limited, 51% in Berger DPI (Pvt) Limited, and 49% stake in 3S Pharmaceutical (Pvt) Limited.

Going forward, management aims to achieve 15-20% topline growth in FY25. Gross margins are projected to improve, contingent on stable raw material prices. Supported by price adjustments, improved customer purchasing power, and recovery in the construction sector, the company anticipates volumetric growth in FY25.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.