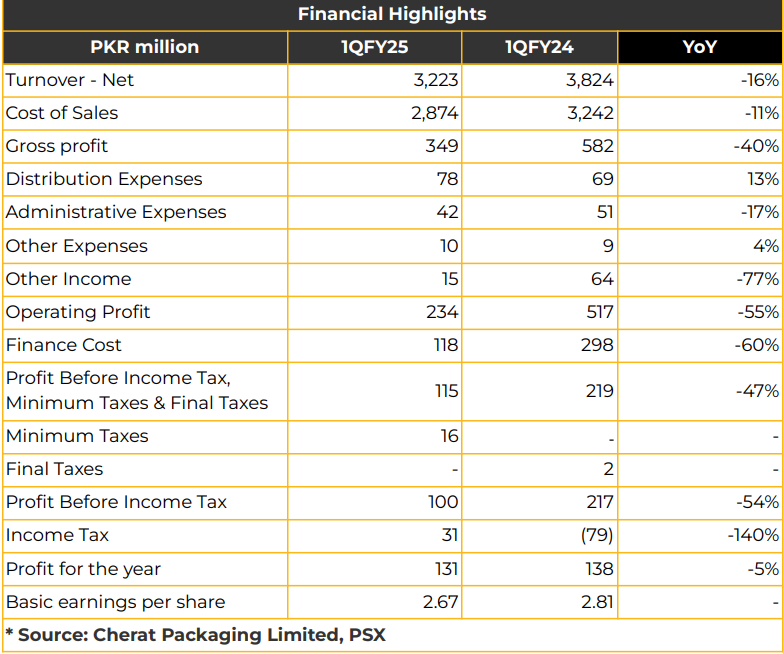

In 1QFY25, Cherat Packaging Limited (CPPL) reported a net profit of PKR 131.03 million, reflecting a 5% YoY decline from PKR 138.02 million in the SPLY.

This translates to an EPS of PKR 2.67, down from PKR 2.81. Topline decreased by 16% YoY to PKR 3.22 billion, compared to PKR 3.82 billion in the SPLY. Gross profit declined by 40% YoY to PKR 348.62 million, while operating profit fell 55% YoY to PKR 233.79 million.

Revenue from the flexible packaging division grew to PKR 1.72 billion in FY24. Distribution expenses increased by 13% YoY to PKR 78.24 million, while administrative expenses dropped 17% YoY to PKR 41.80 million. Finance costs were down by 60% YoY to PKR 118.45 million, largely due to reduced working capital requirements.

Other income fell by 77% YoY to PKR 14.71 million from PKR 63.59 million. For FY24, CPPL’s topline decreased by 17% YoY, reaching PKR 13.82 billion compared to PKR 16.55 billion in the prior year.

Net profit was also down by 2% YoY to PKR 885.89 million from PKR 908.25 million. CPPL faced weakened local demand and increased competition in polypropylene (PP) bags as new competitors and some cement companies established their own PP production lines.

To adjust, CPPL completed the commissioning of its second Flexo Printer in May 2024 and shifted from Kraft to polypropylene bags.

The company sold KP Lines I, II, and IV, with a combined capacity of 240 million Kraft bags, realizing a gain of PKR 811.7 million from the sale.

Proceeds from this sale were used to retire debt, reducing total debt from PKR 2.7 billion in FY23 to PKR 120 million in FY24.

Additionally, a new SOS bags unit is in the pipeline, expected to be commissioned in the current financial year. To manage rising energy costs, CPPL plans to add a 2MW solar plant to its existing 1MW solar capacity, requiring a capex of PKR 200 million.

CPPL’s total energy requirement is 7MW, with a PEDO rate of PKR 15/kWh. As of June 30, 2024, CPPL’s debt-to-equity ratio stood at 25:75, compared to 30:70 in FY23. The operating cycle improved, reducing to 145 days from 162 days last year. The company announced a 45% cash dividend for FY24.

Current and quick ratios improved to 2.68 (FY23: 1.60) and 1.42 (FY23: 0.66), respectively. Interest coverage was reported at 2.25, down slightly from 2.39 in FY23. CPPL now imports 50% of its raw materials, down from 70%, as it has ceased importing Kraft paper.

Going forward, the company plans to realign its business strategy and focus on expansion. Management expects cement demand to remain sluggish in FY25 and aims to expand into non-cement segments.

However, CPPL has no plans to enter the FMCG sector due to its current broader client base. Stable margins are expected in the flexible packaging division.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject to this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.