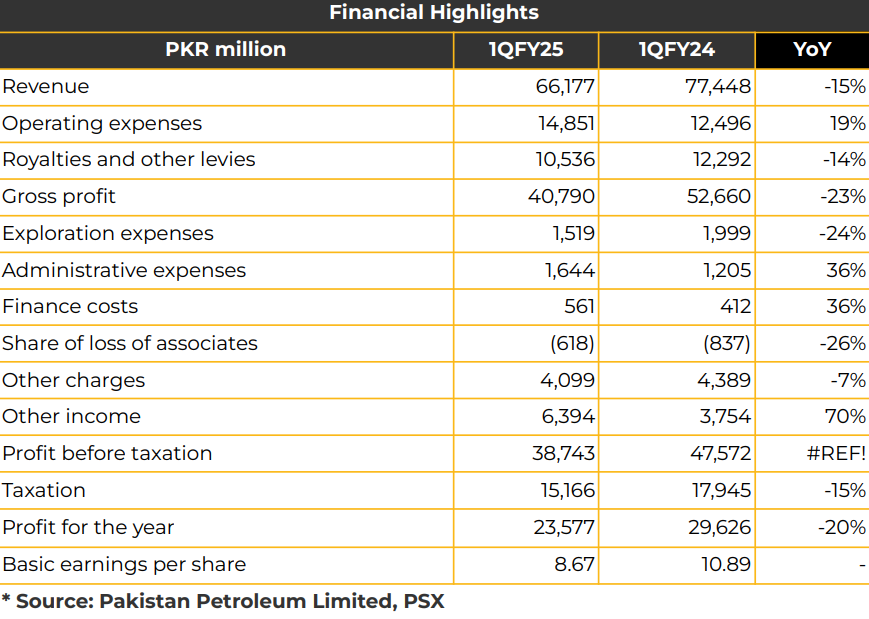

In 1QFY25, Pakistan Petroleum Limited reported net earnings of PKR 23.58 billion (EPS: PKR 8.67), reflecting a 20% YoY decline from PKR 29.63 billion (EPS: PKR 10.89) in the same period last year.

The company’s revenue decreased by 15% YoY to PKR 66.18 billion, with gross profit down by 23%, totaling PKR 40.79 billion.

Operating expenses rose 19% YoY to PKR 14.85 billion, while exploration costs dropped 24% YoY to PKR 1.52 billion in 1QCY25.

Finance costs increased by 36% YoY to PKR 561.31 million in 1QCY25, compared to PKR 411.81 million in the SPLY, due to higher interest rates.

Other income surged 70% YoY to PKR 6.39 billion in 1QCY25 from PKR 3.75 billion in the SPLY. In FY24, PPL achieved its highest net profit after tax at PKR 114 billion. PKR devaluation-driven price gains offset lower sales volumes due to reduced offtakes from Genco and Kandhkot. PPL’s revenue mix for FY24 consisted of gas (61%), oil (32%), and LPG & others (7%), with net sales reaching PKR 289 billion, a 1% YoY increase, driven by favorable price variances and currency devaluation.

Management highlighted that PPL collected PKR 276 billion (including GDS/GIDC) in FY24, raising collections to 81% YOY from 53% YoY.

Price revisions have helped manage circular debt accumulation. Timely finalization of strategies for circular debt resolution remains critical.

For the PIOL project, FPP submissions for the initial three fields are pending approval, expected by year-end. Management intends to use cash flows to settle PKR 60 billion in liabilities in FY25.

Gas production was reported at 713 MMscfd in FY24, down from 815 MMscfd YoY, impacted by natural declines and lower offtakes from Kandhkot. Excessive line pressure from the SNGPL network, driven by increased RLNG imports, also pressured PPL facilities .

Kandhkot’s gas supply remained below the agreed level. Gas supply to GENCO II has dropped from 150 MMscfd to under 100 MMscfd. Field-wise, the gas production breakdown was as follows: Sui (43%), Kandhkot (16%), Adhi (2%), Gambat South (13%), with the remainder from partner-operated fields (26%).

Oil production by field was as follows: Adhi (19%), Tal (35%), Nashpa (29%), Dhok Sultan (8%), and others (9%). The company paid PKR 45 billion in income tax, a 33% YoY decline, due to a one-off reversal on depletion allowance for prior years.

Receivables from Sui Companies rose to PKR 578 billion in FY24, up 13% from PKR 513 billion in FY23. SNGPL and SSGCL represent 46% and 50% of PPL’s receivables, respectively, while GENCO II and other entities make up 1% and 3%. To manage circular debt, PPL is collaborating with the government. Improvements in circular debt accumulation and efforts to address back pressure from RLNG imports are underway.

Management aims to fully recover (currently at 81%) pending circular debt but is also urging the government to issue one-off bonds to settle historical circular debt. A government committee, led by OGDC and including CFOs from the industry, is targeting circular debt resolution by year-end.

The Zafir project in South Gambat was given a stay order in September 2023, with rehabilitation ongoing by PPL. Management cited security and investment challenges in frontier areas but noted high potential for new discoveries.

In FY24, PPL drilled two appraisal wells, with a third exploration well in progress at Offshore Block V in Abu Dhabi through PIOL. Exploratory and development well costs range from USD 3,000 to 4,000 per meter. PPL’s production decline rate has stabilized at 8%, assisted by capacity enhancements, including a 19 MMscfd increase at Sui due to SML compressor upgrades. Frontier area investments, despite security risks, are anticipated to yield high returns, with a target success rate of 3:1 against a typical 10:1.

Onshore seismic survey costs range from USD 25,000-50,000 per square kilometer, while current BOE operating costs stand at USD 3.

Going forward, PPL forecasts 0.7 Bcfde in production and plans eight exploration and two development wells in FY24, with seismic campaigns covering 900 line km 2D and 50 sq km 3D. The FY24 Capex is estimated at PKR 38 billion. The company expects to receive the final Sui D&P lease by December 2024.

However, PPL plans exploration and appraisal wells in Dhok Sultan, Shah Bandar, and Gambat South-operated areas. The BLZ mining feasibility study is progressing, with the operating agreement approved, though financing remains pending. The board approved a 50% equity fund share for the Government of Balochistan . The investment exceeds USD 150 billion in this project.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.