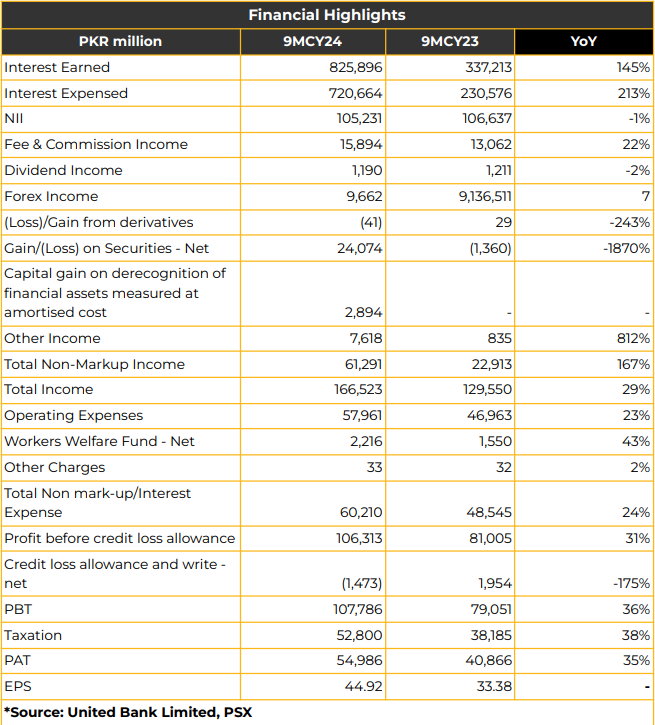

UBL posted a profit of PKR 54.99 billion in 9MCY24 (EPS: PKR 44.92), a 35% YoY increase from PKR 40.87 billion (EPS: PKR 33.38) in SPLY.

Standalone revenue rose by 29% to PKR 166.52 billion, driven by non-funded income, a diversified investment portfolio, and cost-control measures.

Operating expenses grew 23% to PKR 57.96 billion in 9MCY24. UBL paid a record 188% dividend, with a 217% capital gain, and achieved a 405% total return, the highest in the industry, since January 2023.

Management reported that the ADR ratio has been met as of today by reducing high-cost deposits and lending around PKR 200 billion to PASCO. Additionally, the bank is engaged in other secure private lending activities. UBL’s NII slightly declined by 1% YoY to PKR 105.23 billion. Non-markup income surged to PKR 61.29 billion in 9MCY24 compared to PKR 22.91 billion in the SPLY.

This growth was attributed to a 22% increase in fee & commission income, trade & guarantee income up by 59%, card fee by 18%, and remittance commission by 61% YoY. Capital gains included PKR 27 billion, along with a PKR 7.1 billion gain from selling United National Bank Limited (UK subsidiary).

Deposits grew 21% YoY to PKR 2.83 trillion, with current accounts up 32% in 9MCY24. Current to total deposit ratio improved to 53% (CY23: 49%) and the CASA ratio to 92% (CY23: 88%). Domestic performing advances reached PKR 524 billion, improving infection ratio to 4.5% (CY23: 4.7%).

The investment portfolio rose 47% to PKR 6.43 trillion, composed of fixed and floating rate investments, positioning UBL’s balance sheet for further repricing.

The fixed income portfolio totaled PKR 1.16 trillion with a 2.03-year duration and a yield-to-maturity of 15.92%. OMO borrowings stand at PKR 4.16 trillion, with a T-bills portfolio of PKR 3.27 trillion at a 20.51% yield-to-maturity. T-bills worth PKR 2.63 trillion will mature by end-CY24, followed by PKR 525 billion by April 2025, totaling PKR 3.15 trillion in maturities by April 2025. Floating PIBs stand at PKR 1.56 trillion with a yield-to-maturity of 20.91%.

Management highlighted aggressive T-bill and fixed bond positions as a hedge against declining rates, providing an 18-24 months cushion. The investment portfolio holds PKR 103 billion of unrealized gains, with PKR 52 billion net of tax, impacting EPS by PKR 43.

Management noted a government-heavy investment book, while the lending book includes government and private sectors. Management indicated a strategic shift toward investment-grade bonds, now comprising over 90% of their portfolio.

The lending strategy is aligned with the risk profile of individual companies rather than sectors. The leverage ratio will reach 3% in January 2025, with T-bills maturing by end-CY24. The conversion of conventional banks ti Islamic banks in KPK is under discussion, awaiting SECP approval, likely to be completed by November. UBL reported a 21% growth in digital app registrations (4.6 million), a 49% growth in app transactions (95.7 million), and a 53% increase in app throughput (PKR 5.1 trillion). Digital app payments rose 55% YoY.

Transaction volumes in 9MCY24 were split across branch counters (23%), digital apps (47%), and ATMs (30%). Consolidated and standalone CAR stands at 19.15%, with a 6.7% buffer above the regulatory requirement of 12.5%.Consolidated RWA declined by 22% to PKR 1.22 trillion due to the sale of the UK subsidiary, while standalone RWA rose 2% to PKR 1.2 trillion.

UBL operates 1,407 branches, including 241 Islamic branches, with over 500 windows and a presence in UAE, Bahrain, and Qatar. Management affirmed strong liquidity for long-term bonds, with a focus on high-yield bonds. UBL closed PKR 1 trillion in buyback deals as the government repurchased T-bills, realizing a gain in 3QCY24. Management expects policy rates between 12-13%, with a large spread between inflation and interest due to SBP’s FX fluctuation reservations. UBL aims to maintain higher growth in current account deposits and expand market share in trade (currently 8.7%), with a focus on UAE within the GCC. Management anticipates deposits growth exceeding the market average of 15-16%.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a

position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this

report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose