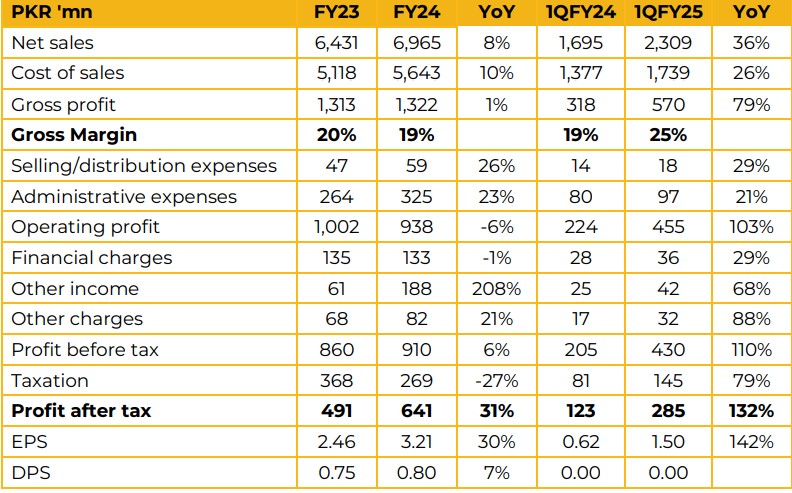

Synthetic Products Enterprises Limited reported earnings per share of PKR 3.21 in FY24 against a earnings per share of PKR 2.46 in FY23, depicting an increase of 30%.

Furthermore, in 1QFY25 the company reported earnings per share of PKR 1.50 against PKR 0.62 in SPLY. In 1QFY25, 20% of revenues were from the auto segment whereas the rest was from packaging.

The company expects that as auto policy incentives begin to expire new OEMs will first launch new models then begin localization. As such, it expects that development for those parts will begin from 2025.

SPEL has currently operates 2.5 MW of solar capacity and has 20% of its electricity needs met through this production. The objective of adding solar power is to keep utility costs under control. The company is also expecting to add 1 MW of solar power to its Karachi plant and will add solar power to its Rahim Yar Khan plant as well.

The management apprised participants of their sustainable growth plan which includes collecting funds generated from profits and amortization to fund capital expenditure while using banks for working capital needs. The company is one of only three producers of steering wheels using in tractors, forklifts and other such vehicles.

It is interesting to note that the other two companies are based out of Italy. The changing destinations of its exports are not due to changing customers but rather due to the global nature of their customers who operate and order to multiple locations.

Majority of its 1 Million USD in exports in 1QFY25 were for the packaging segment. The rise in gross margin to 25% in 1QFY25 from 19% in 1QFY24 was driven by higher capacity utilization. As such the management was of the opinion that margins are similar in export and domestic markets.

Regarding high levels of raw material inventory the management explained that some extra inventory is kept to ensure that shortages do not occur if opening LCs takes longer than expected.

Going forward, the management believes that auto segment will post 25-30% growth. It is expected that profitability will continue to remain strong along with the higher margins seen in the last quarter.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have

a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of

this report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose.