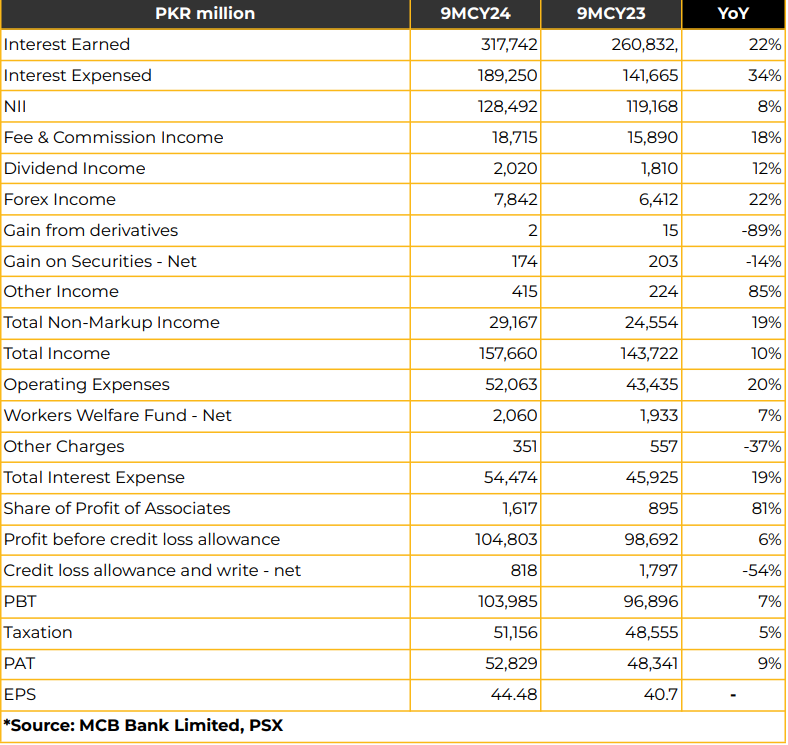

In 9MCY24, MCB reported a profit of PKR 52.83 billion (EPS: PKR 44.48), indicating a 9% YoY increase from PKR 48.34 billion (EPS: PKR 40.70) in the SPLY.

NII surged by 8% YoY to PKR 128.49 billion in 9MCY24, The increase in core earnings was driven by a 22% YoY increase in interest earnings (PKR 317.74 billion), no-cost deposit base and optimized earning asset mix.

Non-markup income rose by 19% to PKR 29.17 billion, driven by fee commission income (PKR 18.72 billion), foreign currency dealing (PKR 7.84 billion), and dividend income (PKR 2.02 billion).

Fee & Commission income expanded by 18% due to a diversified revenue stream and improved customer service. Cards-related income grew by 36% YoY, branch banking fees by 19% and investment service commissions by 54% in 9MCY24. Home remittances income grew with an inflow of USD 3.2 billion during 1HCY24.

The home remittances and trade market share stood at 12.5% and 7.50%, respectively, in 9MCY24. Total income increased by 10% to PKR 157.66 billion, resulting in an improved cost-to-income ratio of 30.93%. Operating expenses increased by 20% year over year to PKR 52.06 billion, driven by staff costs, utilities, and IT-related upgrades in 9MCY24.

Total deposits crossed a milestone of PKR 2 trillion during 9MCY24 while the domestic market share stands at 6.09%. and net investments reached PKR 1.51 trillion (21% up YoY) in 9MCY24. Gross advances increased by 17% YoY to PKR 725.43 billion, with corporate lending and retail loans also experiencing increases of 21% (PKR 531.75 billion) and 2% (PKR 75.37 billion) respectively.

On the other hand, consumer advances declined by 3% YoY to reach PKR 37.44 billion due to macroeconomic challenges in the country.

Overseas loans witnessed an increase of 21% YoY to PKR 49.58 billion in 9MCY24. Domestic market share of MCB in advances improved to 5.60% in 9MCY24.

The yield on advances increased to 18.15% in 9MCY24 from 17.70% in the same period last year. The investment portfolio witnessed 35% YoY growth in floating PIBs (Total: PKR 801.80 billion), whereas fixed PIBs increased by 14% YoY (Total: PKR 243.49 billion) in 9MCY23.

The weighted average time to maturity of PIBs (excluding floating) is 2.91 years. Additionally, PKR 78 billion is scheduled to mature this year.

Treasury bills amounted to PKR 345.10 billion, decreasing by PKR 10 billion. Investment yield increased to 19.35% in 9MCY24 from 17.76% in 9MCY23.

The composition of investments stands at 23% (28% in CY23) for T-Bills, 69% (63% in CY23) for PIBs, 4% for equity securities, 3% (5% in CY23) for other government securities, and 1% for debt instruments. MCB achieved a growth of PKR 978 billion in absolute terms in current deposits and PKR 71 billion in average current deposits with the current deposit mix maintained at 47% by focusing on no-cost deposits. The CASA improved to 97.17% (96.81% in CY23). CoD contained at 9.77% in 9MCY24.

The stable deposit mix of MCB consists of current account deposits (47%), savings deposits (50%), and term deposits (3%). The bank plans to raise the current account deposits to 55% in a couple of years, aiming for 50-51% by CY24. Ex-NIB related recovery FTP ended Sep-24 sums to PKR 772 million totaling PKR 10.4 billion since 2017.

ROE and ROA were reported at 29.98% and 2.47% respectively. The CAR and leverage ratio stood at 21.85% and 6.17%, well above regulatory requirements. MCB has a buffer of 1,035 bps on top of regulatory CAR.

Coverage and infection ratios were reported at 91.98% and 7.59%, respectively during the outgoing quarter. The bank has a Liquidity Coverage Ratio of 263.11% and a Net Stable Funding Ratio of 153.61% against a regulatory requirement of 100%. For Islamic banking, deposits increased by 17% YoY to PKR 239.88 billion, gross advances increased by 3% YoY to PKR 93.29 billion while investments increased by 16% to PKR 154.19 billion in 9MCY24. MCB aims to achieve a target of 300 Islamic branches by the end of this calendar year.

Going forward, MCB plans to prioritize the growth of current accounts, particularly focusing on no-cost deposits and strong recovery efforts.

Management anticipates a compression in NIMs starting from 1QCY25 and aims to achieve an ADR of 50% by the end of CY24. Additionally, management expects a 200-250 bps rate cut in CY24.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From

time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws,

have a position, or otherwise be interested in any transaction, in any securities directly or indirectly

subject of this report Chase Securities as a firm may have business relationships, including investment

banking relationships with the companies referred to in this report This report is provided only for the

information of professional advisers who are expected to make their own investment decisions without

undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents At the same time, it should

be noted that investments in capital markets are also subject to market risks This report may not be

reproduced, distributed or published by any recipient for any purpose.