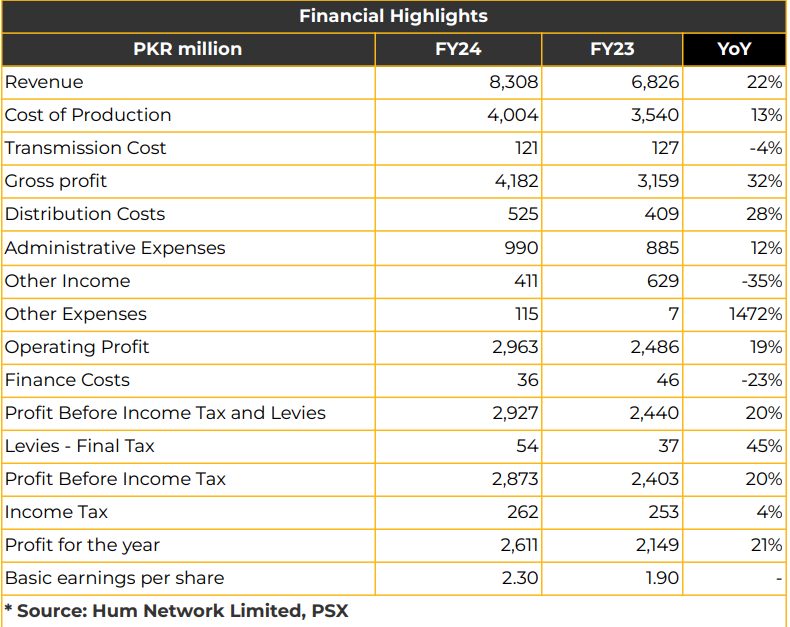

In FY24, Hum Network Limited (HUMNL) reported a 21% YoY increase in net profit, reaching PKR 2.61 billion (EPS: PKR 2.30), up from PKR 2.15 billion (EPS: PKR 1.90) in the prior year.

Revenue rose by 22% YoY to PKR 8.31 billion, compared to PKR 6.83 billion in the SPLY. Gross profit and operating profit saw YoY increases of 32% and 19%, respectively, with gross profit at PKR 4.18 billion and operating profit at PKR 2.96 billion.

Distribution costs rose 28% YoY to PKR 525.22 million, while administrative expenses increased by 12% YoY to PKR 990.12 million. In terms of revenue breakdown, HUMNL reported 64% from advertising, 3% from production, 1.92% from digital revenue, 26% from subscriptions, and 5% from other income in FY24.

Management indicated that subscription revenue includes income from YouTube, while digital revenue derives from advertisements and campaigns on the website and social media platforms.

PACRA reaffirmed HUMNL’s long-term and short-term ratings of “A+” and “A1.” Ten Sports secured major broadcasting and media rights, including a 2-year ICC event coverage contract, the 2025 Champions Trophy, a 2.5-year ICC media rights agreement, a 7-year contract for Cricket Australia’s television rights, a 3-year deal with Cricket Ireland, as well as rights for football, UFC, WWE, and Esports events. Other operating expenses rose significantly to PKR 115.06 million, while other income declined 35% YoY to PKR 410.62 million, from PKR 629.19 million in the SPLY. However, finance costs decreased by 23% YoY to PKR 35.64 million, down from PKR 46.06 million in the prior year.

Over the past five years, Hum Network Limited (HUMNL) achieved a 17.7% CAGR in net revenue, a 27.5% CAGR in profit before taxation, and a 26.7% CAGR in net profit from 2020 to 2024. HUMNL’s global footprint extends across the USA, Canada, the UK, Europe, the Middle East, Sub-Saharan Africa, Bangladesh, and Australia. Going forward, HUMNL aims to expand further through mergers and acquisitions.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From

time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws,

have a position, or otherwise be interested in any transaction, in any securities directly or indirectly

subject to this report Chase Securities as a firm may have business relationships, including investment

banking relationships with the companies referred to in this report This report is provided only for the

information of professional advisers who are expected to make their own investment decisions without

undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents At the same time, it should

be noted that investments in capital markets are also subject to market risks This report may not be

reproduced, distributed or published by any recipient for any purpose.