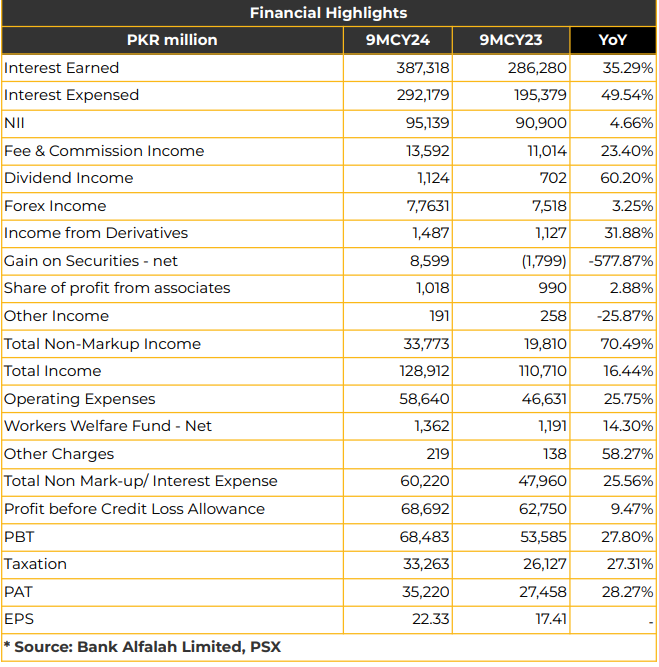

In 9MCY24, Bank Alfalah Limited witnessed a 29% YoY jump in net profitability, reaching PKR 35.22 billion (EPS: PKR 22.33), compared to PKR 27.46 billion (EPS: PKR 17.41) in the corresponding period last year.

The bank’s NII surged by 5% YoY to PKR 95.14 billion in 9MCY24, up from PKR 90.90 billion in SPLY, driven by a 36% increase in interest earnings (PKR 387.32 billion).

Management reported that the volumetric growth offset the decline in spread. Additionally, non-mark-up income rose by 70% YoY to PKR 33.77 billion, led by higher fee and commission income (up by 23% YoY), dividend income (up by 60% YoY), and increased forex income (up 4% YoY). However, capital gain on government securities increased to PKR 8.60 billion compared to the PKR 1.80 billion loss in the SPLY.

Total non-mark-up expenses rose by 26% YoY to PKR 60.22 billion.

In 9MCY24, The bank witnessed a substantial 89% YoY and 71% QoQ decrease during 3QCY24 in provisions, reflecting strong asset quality and better recoveries & reversals

. Furthermore, the bank has adopted the expected credit loss model under IFRS-9, resulting in a positive impact of Rs. 2.0 billion (net of tax) on opening equity as of the adoption date.

Net Interest Margins (NIMs) contracted to 5.4% in 3QCY24 from 5.5% in SPLY, as the cost of funds rose more sharply than asset yields.

The 23% YOY increase in reserves reflects the impact of the 2023 final dividend of Rs. 7.9 billion, the 1QCY24 interim dividend of Rs. 6.3 billion, and the IFRS 9 opening ECL adjustment.

The cost-to-income ratio increase has started to normalize. The bank reported ROE and ROA at 28.6% and 1.2% respectively in 3QCY24. Bank Alfalah Limited held market shares of 6.4% in deposits, 7.1% in advances, 8.1% in trade, and 16.5% in remittances.

The bank experienced 17.3% YoY growth in deposits, crossing the PKR 2.1 trillion mark, with current deposits increasing by 14.6% YoY in 9MCY24. Management reported that the drop in deposits is due to a shift in the bank’s strategy to improve ADR. Moreover, the current deposits reflect a shift in customer’s preferences.

Furthermore, Bank Alfalah Limited ranked second in home finance and credit card ENR. In auto finance, the bank held the third position with a 15.8% market share.

The deposit mix comprised 41% current deposits, 32% savings deposits, and 28% term deposits, with conventional deposits accounting for 75%, Islamic for 18%, and overseas for 7%. However, advances grew by 29% YoY as the bank aimed to meet ADR targets, while a more cautious lending approach led to an 11% QoQ increase, resulting in a lower gross ADR of 44.9%. The drop in ADR is due to cautious lending amid prevailing economic/business conditions and a strong deposit base.

Management reported that growth in advances is still lower despite monetary easing. Borrowing increased 43% YoY and dropped 15% QoQ in 9MCY24.

The infection ratio was reported at 4.6% due to subjective classification. Nevertheless, the coverage ratio remained healthy at 114% in 3QCY24.

Management reported that NPLs were affected by an IFRS-9 clarification issued by the SBP, which now mandates classification at the customer level.

Investments saw a substantial 27% year-over-year increase, with the portfolio primarily weighted towards floater PIBs and T-Bills. Fixed PIBs accounted for just over 25% of the portfolio, offering an average yield of slightly under 14.4%.

The Capital Adequacy Ratio (CAR) stood at 19.04%, and the CASA ratio improved to 71.3% in 3QCY24 as the bank looked to improve the deposit mix.

The book value per share improved to PKR 106.00. Bank Alfalah Limited operates 1070 branches, including more than 375 Islamic Branches, in 240 cities in Pakistan.

It has an international presence with ten international branches and one offshore banking unit in four countries. Additionally, the bank inaugurated its first-ever Digital Lifestyle with a Digital Transaction Ratio of 95% and Digital Throughput of PKR 3.7 billion (PKR 2 billion in 2QCY24) in 3QCY24.

In digital banking, the digital throughput and migration ratios improved by 48% (PKR 4 trillion) from September CY23 and 85% YTD. G2P payments increased by 18% to PKR 184.9 billion, and digital lending grew by 68% to PKR 23.6 billion from September CY23. BAFL also launched two sales & service centers in Gulshan & Badar commercial markets. BAFL plans to add 3 more centers that are under development.

Going forward, management intends to enhance the deposit mix, aiming to achieve a current deposit ratio of approximately 44-45%, while also expanding the advances book by leveraging existing customer relationships. Additionally, BAFL targets reaching a 50% ADR by the end of CY24.

The bank expects the MPC to continue lowering interest rates, forecasting a rate of 12% by January 2025. It plans to pursue aggressive branch expansion in the coming year. The cost-to-income ratio is anticipated to stabilize at around 55% while operating expenses are projected to exceed 20% in CY25.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose