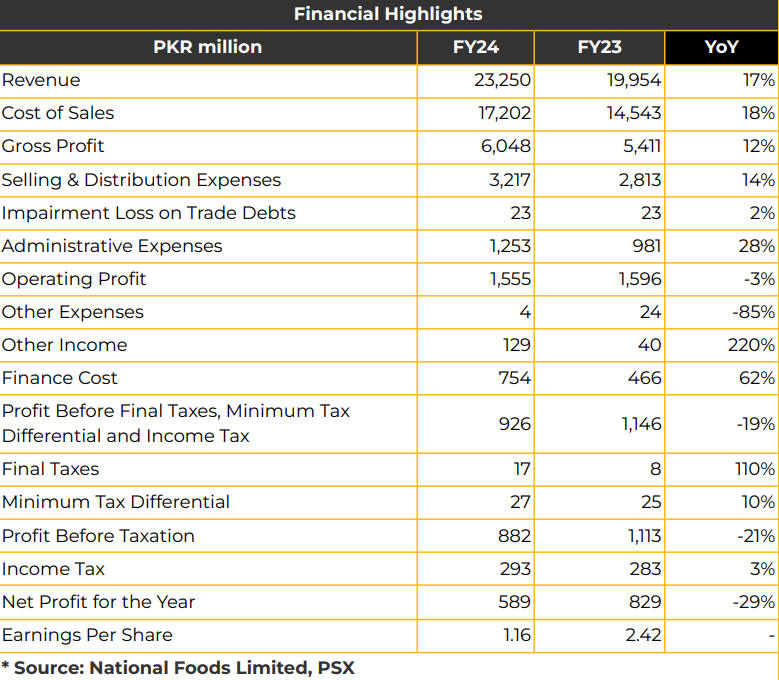

In FY24, National Foods Limited (NATF) saw a 29% YoY decline in net profits, reaching PKR 589.10 million (EPS: PKR 1.16), down from PKR 829.38 million (EPS: PKR 2.42) in the previous year.

Despite this, the company achieved a 17% YoY growth in revenue, totaling PKR 23.25 billion, driven by exceptional growth in A1 Cash & Carry and other revenue-driven initiatives.

Gross profit increased by 12% to PKR 6.05 billion, though operating profit declined by 3% to PKR 1.55 billion due to a 14% increase in selling and distribution (S&D) expenses and a 28% rise in administrative costs.

NATF anticipates further increases in S&D expenses as part of its ongoing investments and expansion efforts.

NATF operates across Pakistan, KSA, UAE, UK, USA, and Canada, with exports to 40 countries and a distribution network of 300 distributors.

Cost of sales rose 18% YoY to PKR 17.20 billion in FY24, and finance costs surged by 62% YoY to PKR 753.76 million due to higher inflation and interest rates.

The company’s long-term financing totals PKR 6.2 billion. Profit before tax declined by 21% YoY to PKR 881.60 million, compared to PKR 1.11 billion in the SPLY. ROE, ROA, and ROCE were reported at 16%, 6%, and 24%, respectively.

NATF’s portfolio spans 194 SKUs across ten categories. It holds a leading market share in the culinary and condiments divisions.

The company leads in recipe mixes, followed by spices, ingredients, and salt and seasoning. In the condiments category, NATF is the market leader in ketchup with a 59% market share, followed by pickles. Revenue from ketchup totaled PKR 9.5 billion and Pickles PKR 5.5 billion NATF operates three plants at Port Qasim, Nooriabad, and Faisalabad, with an annual production capacity of 200,000 tons.

Additionally, NATF is considering the sale of its SITE plant in Karachi, which covers approximately one acre. The group crossed the PKR 105 billion topline mark in FY24, achieving 25% YoY growth in net sales.

However, operating profit declined by 18% YoY due to continued investments and higher interest rates, which impacted financing costs. A1 Cash & Carry, NATF’s Canadian business, saw a 42% growth, now operating eight stores across Canada with 12,000 SKUs in nine categories. A1 Cash & Carry has completed seven years of partnership with NATF, contributing CAD 242 million (26% YoY growth) to the group, with a 42% growth in local currency.

This business now accounts for 48% of group net sales, and management estimates its valuation at over CAD 300 million. The Faisalabad plant, spanning 30 acres, has been completed, with total capex rising to PKR 7 billion due to inflationary pressures, up from PKR 4.5 billion in Phase I.

The company is expected to benefit from a ten-year tax incentive starting in 2024 due to its location in the Specialized Economic Zones (SEZs). In local business, NATF achieved a milestone of PKR 50 billion in sales.

The company also expanded internationally by establishing a manufacturing facility in Dubai. To address raw material challenges, NATF initiated a ‘seed to table’ project in collaboration with farmers, producing 8,500 MT of tomatoes across 500 acres. NATF achieved 20-25% localization in tomato paste production and benefitted from a bumper crop in FY24 NATF’s raw material mix consists of 80% of imported materials.

The company has also initiated market penetration into Karachi by launching its spices product line, with plans for further expansion.

Going forward, NATF aims to improve volumes by expanding into northern regions, where 65% of customers are located, and leveraging growth in A1 Cash & Carry.

The company plans to open 2-3 stores annually in Canada, expanding beyond Toronto. NATF expects double-digit growth in operating profit and EBITDA, supported by a stable currency and lower inflation, and projects exports of PKR 14-15 million. In the medium term, the company plans to continue investing outside Pakistan. NATF expects to double its volumes in five years.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.