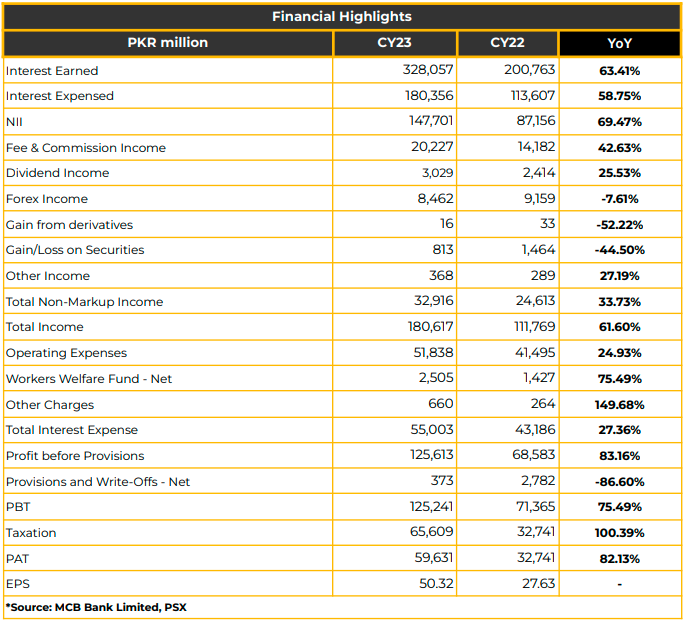

In CY23, MCB reported a record profit of PKR 59.63 billion (EPS: PKR 50.32), indicating an 82.1% YoY increase from PKR 32.74 billion (EPS: PKR 27.63) in the same period last year.

The Net Interest Income (NIMs) surged by 69.5% to PKR 147.70 billion in CY23, driven by a 63.4% YoY increase in interest earnings (PKR 328.06 billion) due to no-cost liabilities and higher policy rates.

Non-markup income rose by 33.7% to PKR 32.92 billion, driven by fee commission income (PKR 20.23 billion), foreign currency dealing (PKR 3.03 billion), and dividend income (PKR 812.66 million). The home remittances market share improved to 12.3% (11.5% in CY22) in CY23.

Fee Commission income expanded due to a diversified revenue stream and improved customer service. Trade and guarantee-related business income increased by 111% YoY, cards-related income by 49% YoY, and home remittances income grew by 26% YoY with an inflow of USD 3.25 billion during CY23.

Total income increased by 61.6%, resulting in an improved cost-to-income ratio of 28.70% during the period.

On a consolidated basis, the bank’s PBT increased to PKR 137.52 billion, with profit after tax standing at PKR 65.27 billion, higher than PKR 34.45 billion in the same period last year. This increase was attributed to strong growth in current accounts and NII.

Total deposits and investments reached PKR 1.8 trillion (31% up YoY) and PKR 1.25 trillion (28% up YoY) respectively.

However, gross advances decreased by 22% YoY (PKR 175 billion) to PKR 622 billion, with corporate lending and retail loan portfolios also experiencing declines of 28% (PKR 168.5 billion) and 16% (PKR 13.6 billion) respectively. The yield on advances increased to 17.9% in CY23 from 11.4% in the same period last year, with the decline in demand witnessed from SMEs and small enterprises.

Advances are being utilized for short-term working capital requirements by the corporate sector.

Segment-wise advances witnessed a decline except overseas segment. Bank reported advances of PKR 74 billion for retail, PKR 438 billion for corporate, PKR 39 billion for consumer, PKR 41 billion for overseas, and PKR 31 billion for others in CY23. MCB advances for the domestic market were PKR 581 billion in CY23.

The investment portfolio witnessed growth in floating (Total: PKR 595.1 billion) by PKR 67 billion, whereas fixed PIBs (Total: PKR 213.4 billion) declined by PKR 76 billion in CY23. The weighted average time of PIBs (excluding floating) is 2.95 years.

Treasury bills amounted to PKR 354.8 billion, increasing by PKR 223.2 billion. Investment yield increased to 18.32% in CY23 from 12.41% in the same period last year.

The composition of investments stands at 28% (13% in CY22) for T-Bills, 63% (80% in CY23) for PIBs, 4% for equity securities, 5% (2% in CY22) for other government securities, and 1% for debt instruments.

MCB achieved resilient growth of PKR 190.5 billion in absolute terms in current deposits and PKR 180 billion in average current deposits (current deposit base 28% up YoY) by focusing on no-cost deposits.

The current-to-total deposits ratio and CASA improved to 50.5% and 95.93% respectively. CoD contained at 8.64% despite a sharp increase in the policy rate in CY23. The deposit mix of MCB consists of current account deposits (48%), savings deposits (49%), and term deposits (3%).

Total recoveries related to NPL stock transferred from NIB bank were PKR 9.67 billion. ROE and ROA were reported at 31.60% and 2.64% respectively. The CAR and leverage ratio stood at 20.39% and 6.17%. MCB has a buffer of 889 bps on top of regulatory CAR.

The bank has a Liquidity Coverage Ratio of 250.62% and a Net Stable Funding Ratio of 147.41% against a regulatory requirement of 100%.

Operating expenses of the bank increased by 25% YoY to PKR 51.8 billion, driven by investment in human resources, technology, and higher inflation.

For Islamic banking, deposits grew by 33% to PKR 204 billion, gross advances remained steady at PKR 90 billion, and investments increased by 82% to PKR 133 billion. MCB added 27 new Islamic branches in CY23 and aims to achieve a target of 300 Islamic branches by the end of this financial year.

Looking ahead, MCB plans include addressing interest rates and inflation in CY23, focusing on no-cost deposits, controlling operational costs, and diversifying the portfolio. Management expects ADR taxation to impact the deposit mobilization of the bank.

The management also anticipates continued fiscal dependence on the banking sector, and lower private sector credit demand.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.