In CY23, Engro Corporation Limited (ENGRO) reported a consolidated net profit of PKR 36.09 billion (EPS: PKR 63.01), indicating a significant 22% YoY decline compared to the PKR 46.11 billion net profit (EPS: PKR 42.23) in the corresponding period of the prior year. The decrease in net profitability was attributed to the imposition of super tax and thermal asset divestment.

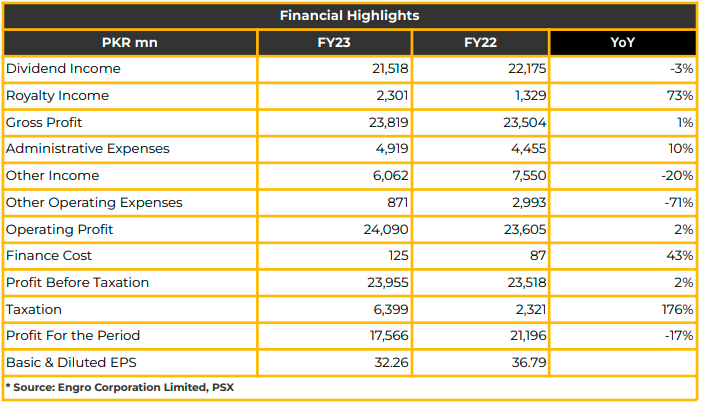

Unconsolidated profitability stood at PKR 49.61 billion (EPS: PKR 32.26) in CY23, down from PKR 68.90 billion (EPS: PKR 36.79) last year. The impact of the recoverable amount of thermal energy assets on unconsolidated profitability was negligible. However, additional super tax on dividends and higher interest rates impacted ENGRO’s profitability negatively.

The net assets of the thermal energy assets in the consolidated financial statements of the group exceeded their recoverable amounts. Consequently, an accounting impact of the owner’s share of Rs13bn (Total PKR 30bn) was recognized in the consolidated financial statements due to the remeasurement of thermal assets in CY23. This accounting impact will not affect cash flow, and the gain will be realized in the standalone financials of energy upon transaction realization.

The purpose of divestment was to rebalance the portfolio by moving away from government-dependent businesses and exploring commercial alternatives. The management is yet to decide on reinvesting the cash received from this divestment.

Management indicated to opt for sale purchase agreement instead of share purchase agreement with the potential buyer.

Management clarified that the higher net assets in consolidated financial statements for IPPs were due to the debt component recovered from CPPA-G as part of the tariff in revenue, while the corresponding depreciation expense is recorded over the term of the Power Purchase Agreement (30 years).

The company’s consolidated revenue for CY23 reached PKR 482.49 billion, showcasing a significant 35% YoY growth from PKR 356.43 billion reported in the same period the previous year. The increase in topline was attributed to higher urea sales (2,327KT), efficient plant operations, increased earnings from dollar-denominated businesses, and efficiencies derived through cost optimization.

Engro Fertilizer Limited (EFERT) achieved revenue and profitability of PKR 224 billion and PKR 26.2 billion in CY23, driven by the highest production and sales of urea and import substitution of USD 800 million.

Engro Polymer Limited (EPCL) witnessed a decline in revenue and profitability, reaching PKR 81 billion and PKR 8.9 billion, respectively, in CY23 due to the economic slowdown. However, EPCL maintained a market share of PVC at 89% and exported 44 KT of volumes.

Gas curtailment and macroeconomic dynamics affected the operations of Engro Elengy & Vopak, resulting in a 28% YoY decline in chemicals handled and a 37% market share. Management reported a total gas demand of around 13-15%.

Engro Enfrashare Limited experienced a 19% increase in operational sites, reaching 3,952 sites and capturing 64% of the ITC colocation market. Additionally, the company achieved a market share of 57% YoY after adding 623 more towers, reaching 4,000 towers in the country. Enfrashare invested PKR 21 billion in this project with a debt-to-equity ratio of 60:40. Management forecasts a total demand of 8,000-10,000 towers.

Higher interest income and efficient plant operation increased profitability of Engro Energy Limited to PKR 2.6 billion, with mining increasing to 7.6 MT and dispatches of 4,481 GWh in CY23. The company aims to enhance mine capacity to 11.4MT by the end of 2024.

Engro Eximp FZE achieved a revenue of USD 406 million and a traded volume of 667KT in CY23. The company aims to explore other markets and non-captive space.

FrieslandCampina Engro achieved revenue of PKR 100 billion while profitability declined by 39% YoY to PKR 1.5 billion due to higher interest costs.

Going forward, the management anticipates the rebound of Phosphate and PVC demand due to better farm economics. Besides, ENGRO management is awaiting a more liberalized power sector for renewable ventures and a favorable macroeconomic environment to pursue polypropylene projects, which are currently on hold.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.