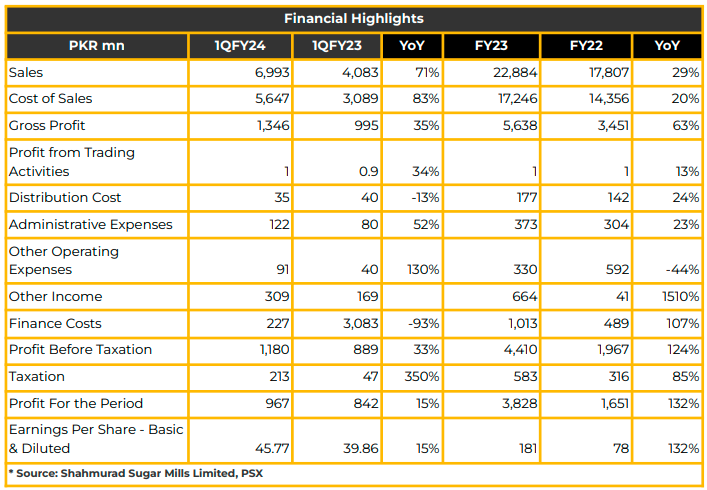

In 1QCY24, Shahmurad Sugar Mills Limited saw a net profit of PKR 966.55 million (EPS: PKR 45.77), a significant improvement from the PKR 841.80 million net profit (EPS: PKR 39.86) in the same period last year.

The company’s FY23 revenue reached PKR 22.88 billion, indicating a notable 29% YoY growth from the PKR 17.81 billion reported in the corresponding period of the previous year. During FY23, gross profit increased by 63% YoY to PKR 5.64 billion, while the cost of sales rose by 20% YoY to PKR 17.25 billion due to increased raw material costs.

FY23 reported gross profit margin and EBITDA margins at 24.64% and 25.27%, respectively, showing an improvement from the previous year. Management attributed this improvement to the favorable impact of currency devaluation. ROE and ROA were recorded at 27.7% and 35.8%, respectively, during the same period.

The current ratio and debt-to-equity ratio stood at 1.58 (1.21 in FY22) and 24.04 (6.42 in FY22). SHSML’s equity was reported at PKR 13.82 billion, with debt at PKR 575 million. The FY23 EPS was reported at PKR 181.24 (PKR 78.17 in FY22).

Distribution and administrative expenses increased by 24% YoY and 23% YoY to PKR 176.76 million and PKR 373.45 million, respectively, during the said period. Finance costs rose to PKR 1.01 billion in FY23, attributed to higher interest rates compared to PKR 488.79 million in FY22.

In the Sugar Division, crushing production was recorded at 567,913 MT, lower than the previous year, while sugar production was reported at 60,303 MT. In the Ethanol Division, ethanol production was recorded at 69,738, in line with the production in FY22.

The sugar division produced 463,955 MT of sugar up to the end of January, with an average sucrose recovery of 10.73%. The ethanol division produced 18,660 MT of ethanol up to January end.

Due to the revaluation in FY23, the company witnessed an increase in fixed assets, which stand at PKR 10.86 billion compared to PKR 5.55 billion last year. Management shared a diversion from Europe to Asian markets due to supply-chain disruptions which increased freight and shipment costs. However, the company plans to revive its European presence as soon as the geopolitical situation improves.

Ethanol sales are running at 100% capacity of 6,000 tons per month, but container availability remains a key challenge. Additionally, axle load implementation is causing challenges for the company.

Looking ahead, management anticipates improving production. However, they expect ethanol levels to remain the same, citing supply chain issues globally and political and economic challenges domestically.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.