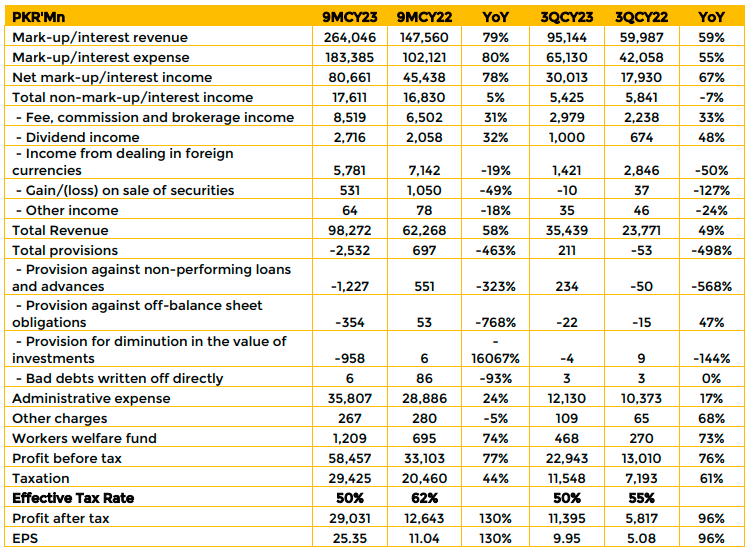

Allied Bank reported a consolidated net mark-up and interest income of PKR 80.66 Bn in 9MCY23, up 78% from PKR 45.44 Bn in SPLY.

Non markup and interest income was recorded at PKR 17.6 Bn in 9MCY23 representing 5% growth when compared to PKR 16.8 Bn in 9MCY22.

As a result, consolidated gross income surged 58% to PKR 98.2 Bn in 9MCY23 from PKR 62.3 Bn in SPLY.

Operating costs in the period increased 25% to PKR 37.3 Bn in 9MCY23 from PKR 29.9 Bn in 9MCY22. This was driven primarily by a 34% increase in other operating costs alongside a 12% increase in human resource costs.

In 9MCY23, Allied Bank recorded consolidated profit before tax of PKR 58.5 Bn. This is 77% more than PKR 33.1 Bn in 9MCY22. Similarly, taxation costs for the company went from PKR 20.5 Bn in 9MCY22 to PKR 29.4 Bn in 9MCY23, an increase of 44%.

The bank reported consolidated profit after tax of PKR 29 Bn in 9MCY23, surging 130% from PKR 12.6 Bn in 9MCY22. The bank has also seen its total assets rise 1% from PKR 2.253 Tn as of Dec’22 to PKR 2.266 Tn as of Sep’23. Net assets grew 18% from PKR 130 Bn on Dec’22 to PKR 153 Bn on Sep’23.

Allied Bank has also seen 19% growth in Tier 1 equity from PKR 125 Bn at the end of CY22 to PKR 148 Bn at the end of 3QCY23. Additionally, total equity was up 18% in the same period from PKR 130 Bn to PKR 153 Bn.

Allied Bank saw its return on assets rise to 1.7% as of Sep’23 against 1% as of Dec’22. Similarly, a growth in return on tier 1 equity was seen from 18.4% to 28.6% in the same time period.

The Bank’s capital adequacy ratio stands at 22.61% as of Sep’23 showing a rise from 19.74% as of Dec’22. The bank has opened 21 conventional branches and 25 Islamic banking windows bringing the total to 1474 and 160 respectively. It has also added 42 new ATMs bringing the total in its network to 1569.

As of September 30, 2023, the bank has also opened 1.15 Mn new accounts to bring its total to over 7.61 Mn. Allied Bank has also launched an industry first Allied Freelancer Account to cater to a greater number of customers. Additionally, Allied bank is continuing to work to expand its e-commerce payment alliances with leading merchants.

Going forward Allied bank expects a 1-4% reduction in the SBP policy rate over the next year as inflation cools. It also does not expect an unusual rise in NPLs.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.