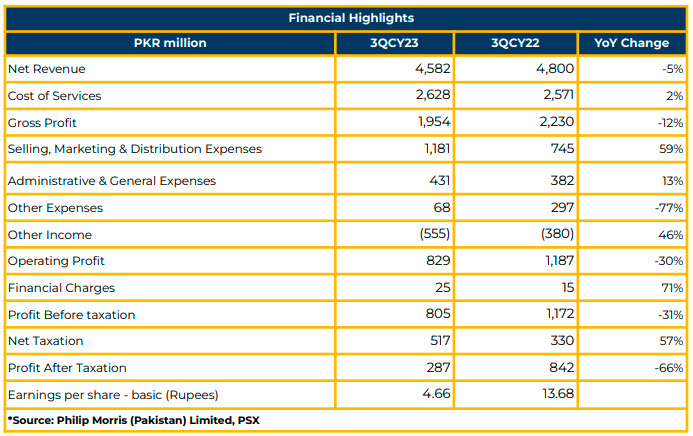

In 3QCY23, Philip Morris (Pakistan) Limited reported a net profit of PKR 287.24 million (EPS: PKR 4.66), a decrease from the net profit of PKR 842.31 million (EPS: PKR 13.68) in the corresponding period of the previous year.

The net revenue exhibited a 5% YoY decline, reaching PKR 4.58 billion in 3QCY23, compared to PKR 4.80 billion in the corresponding period last year. Simultaneously, the gross profit witnessed a 12% YoY decrease, reaching PKR 1.95 billion in 3QCY23, down from PKR 2.23 billion in the same period last year.

The cost of sales experienced a 2% YoY surge, reaching PKR 2.63 billion in 3QCY23, compared to PKR 2.57 billion in the corresponding period last year. Similarly, finance costs escalated to PKR 25.27 million, while taxation decreased by 57% YoY to PKR 517.37 million in 3QCY23.

In 9MCY23, the net turnover witnessed a decline of 9% YoY to PKR 13.64 billion, compared to PKR 14.97 billion in the SPLY. Volumes declined by 44% YoY in 9MCY23.

Gross profit dropped by 22% YoY to PKR 5.34 billion in 9MCY23, compared to PKR 6.88 billion in SPLY. Profit after tax was PKR 659 million during the said period, despite economic headwinds, against PKR 2.38 billion last year.

Gross margins, operating margins, and net margins were reported at 39%, 12%, and 5%, respectively, in 9MCY23. On average, PMPK contributed 60% to the national exchequer as a percentage of gross turnover.

In FY23, the unprecedented excise hike in February stood at 217% for premium tier products, and 206% for value tier. The crossover price and legal minimum price increased by 52.3% and 103.2% in February this year.

The prices of different products after the excise hike are as follows: Marlboro PKR 483 (91% up), Red & White Special PKR 212 (112% up), Red & White KSF PKR 160 (50% up), Diplomat PKR 140 (31% up), Morven Classic PKR 140 (94% up), Morven by Chesterfield PKR 21 (98% up), and Parliament 160 (70% up).

The company successfully launched ZYN in Lahore, Karachi, Islamabad, and Peshawar. Regarding sustainability, PMPK achieved a 45% reduction in water consumption per million cigarettes in the Sahiwal factory in 2022. The company achieved zero effluent discharge at this factory and is working towards water stewardship in Mardan.

PMPK won the first ESG award from the American Business Council for CSR initiatives in 2023. The Gujranwala branch switched to solar energy to reduce carbon footprints. Moreover, the company launched a program for females to rejoin the workforce after a career break. Furthermore, Philip Morris (Pakistan) Limited worked with farmers to encourage fuelwood utilization and crop diversification.

Additionally, the company provided 199 stringing machines to make stick-tying convenient for children. Moreover, PMPK empowered 756 young girls and boys through its skill training programs.

Going forward, the tobacco company is dedicated to maintaining a strong commitment to efficient operational management in the face of any economic challenges.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.