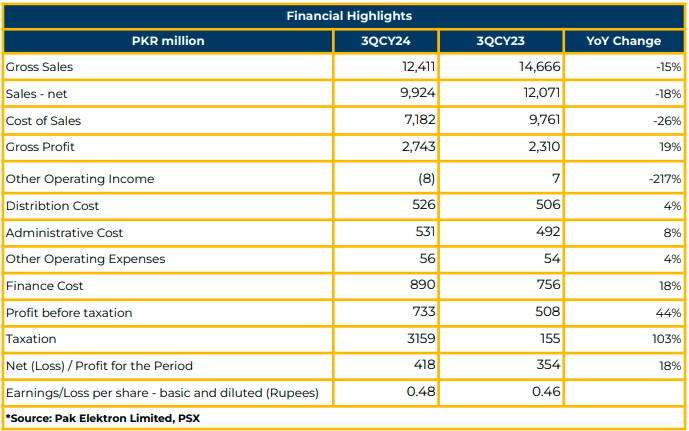

In 3QCY23, Pak Elektron Limited (PAEL) reported a net profit of PKR 417.75 million (EPS: PKR 0.48), signifying a significant increase from PKR 353.80 million (EPS: PKR 0.46) in the corresponding period last year.

Despite a 15% YoY decrease in gross sales to PKR 12.41 billion, gross profit saw a notable increase of 19% YoY, reaching PKR 2.74 billion during the said period.

Cost of sales decreased by 26% YoY to PKR 7.18 billion, while administration and distribution expenses increased by 8% YoY and 4% YoY to PKR 530.62 million and PKR 525.77 billion in 3QCY23. The finance cost of the company increased by 18% YoY to PKR 889.87 million compared to PKR 755.89 million in SPLY.

In FY23, despite a 50% reduction in value due to import restrictions, the overall net proft margin doubled by 3.1% compared to 1.5% YoY. Management shared growth plans for 2024, targeting a 36% increase in gross sales, 39% in net sales, and 160% in PAT, with an expected 7% gross profits margins.

Gross profit margin increased to 25% in FY23, despite economic headwinds, and is expected to reach 27% in FY24 through optimized operations and passing on price increases.

PAEL aims to reduce two-thirds (PKR 9.8 billion) of debt by FY24, already reducing debt to PKR 14.6 billion in FY23 from PKR 23.7 billion in FY22. Working capital targets are set to reduce to 27% of net sales for the Appliance Division and 25% in the Power Division by FY24.

In FY22, the Power Division generated PKR 27.4 billion in sales, expected to increase to PKR 29.8 billion next year. By expanding distribution channels to enhance efficiencies and improve the conversion cycle, the management successfully increased margins in FY23.

Credit days were trimmed down from 37 days to 24 days compared to FY21. Furthermore, inventory days experienced a reduction from 80 days in FY21 to 53 days in FY23. Appliance Division sales stood at PKR 25.2 billion in FY23, estimated to increase to PKR 44.1 billion in FY24.

PAEL maintains market share and plans to explore new market opportunities. Higher margins were achieved by the company through substantial price increases and strategic investments in growth-oriented categories.

Notably, credit days decreased from 126 days in FY21 to 83 days in FY23. Similarly, inventory days for the appliance division decreased from 128 days in FY21 to 119 days.

PAEL holds the third position in the appliance industry, which is valued at PKR 400 billion, and continues to explore opportunities to penetrate the market further.

The market shares for various categories are as follows: Refrigerator and Freezers (20%), Air Conditioner (8%), Water Dispenser (33%), Washing Machine (4%), and LED (3%). PAEL intends to sustain its market presence in the first three categories while strategizing to expand its

market share in the last two categories.Owing to limitations on LCs, a shortage of foreign exchange reserves, and elevated prices of appliance products, the company faced constraints in pursuing Parasonic partnership initiative in the second year.

However, in FY24, PAEL is poised to resume progress on the Panasonic partnership and proceed with launching products thereafter.

The expected demerger of Power and Appliance Divisions is not materializing due to the lack of a strategic partner.

The company relies on 70% imported raw materials, with the remaining 30% sourced locally. Urban demand for appliance products accounts for 60%, while rural demand is at 40%. In FY24, the management anticipates growth of 30% in refrigerators, 35% in air conditioners, and 45% in deep freezers, collectively contributing to 83% of total revenue.

The company does not have plans for expansion, as existing capacities are deemed sufficient to meet current market demands. Notably, the company has already secured orders worth PKR 14-16 billion in the power division, covering 50% of the anticipated revenue for FY24.

PAEL primarily exports to Africa and Middle East and plans to tap USA market because of the higher trade tariffs of Chinese products and boom of power transformers there.

Looking ahead, PAEL aims to maintain market share, introduce cost efficiencies, and pay dividends after clearing all debt.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.