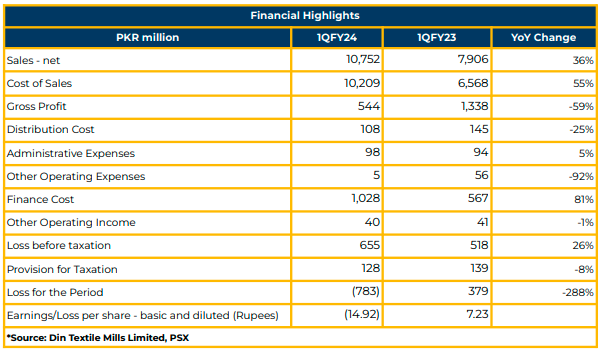

In 1QFY24, Din Textile Mills Limited (DINT) reported a net loss of PKR 782.69 million (LPS: PKR 14.92), reflecting a decline from the net income of PKR 379.08 million (EPS: PKR 7.23) in the corresponding period last year.

Despite the setback, the company experienced substantial revenue growth, reaching PKR 10.75 billion in 1QFY24, marking an impressive 36% YoY increase from the PKR 7.91 billion reported last year.

Cost of sales rose by 55% YoY to PKR 10.21 billion in 1QFY24. Administrative expenses increased by 5% YoY to PKR 98.34 million, whereas distribution expenses decreased by 25% YoY to PKR 107.82 million in the same period.

The finance cost of the company increased by 81% YoY to PKR 1.03 billion in 1QFY24 from PKR 566.97 million in SPLY. Gross profit recorded a substantial decrease of 59% YoY, reaching PKR 543.62 million in 1QFY24.

In FY23, the company achieved its highest revenue, up 3% YoY, reaching PKR 32.31 billion compared to PKR 31.35 billion in SPLY. DINT incurred a net loss of PKR 867.52 million (LPS: PKR 16.53) in FY23 against net income of PKR 3.44 billion in SPLY.

Total assets and total Capex witnessed an increase of 35% YoY and 223% YoY to PKR 37.99 billion and PKR 4.01 billion, respectively, in FY23.

The long-term debt of the Company reached PKR 8.24 billion in FY23 compared to PKR 7.05 billion in SPLY. Debt to total assets and debt to equity were reported at 32.75% and 260.46%, respectively, in SPLY.

Donations registered a tremendous increase of 804% YoY, reaching PKR 12.15 million compared to PKR 1.51 million in SPLY.

The wealth generation breakup is as follows: Material & Factory Cost (81%), Administrative & Other expenses (1%), Broker’s Commission (1%), Value Added (16%), and distribution (1%).

Similarly, the wealth distribution breakup is as follows: Mark up paid on borrowed fund (44%), Salaries & Benefits (26%), decline in Profit Retained (13%), and Depreciation (14%) in FY23.

The management reported a decrease in profit margins to 1.93% and a decline in ROE to 6.69% during the said period.

DINT operates four spinning units with 134,928 spindles, one dyeing unit with a capacity of 13 tons per day, and one weaving unit with 144 air jet looms.

Going forward, the management anticipates that lower international prices will offset the increase in exports. Likewise, the high-quality bumper cotton crop this year is expected to improve margins. The management indicated a shift in focus towards debt retirement instead of pursuing further expansion.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.