Gharibwal Cement in its Corporate Briefing today informed investors about its different ongoing projects which include a 10,000 TPD expansion, a cooler retrofit, a solar power plant for 10MW along with a multi fuel power plant of 10MW for which a turbine has already been purchased.

On the 10,000 TPD expansion, management confirmed that the pyro process plant has been received and civil work is ongoing. The management indicated that the expansion would move faster once interest rates declined going forward. No definitive date was given for the completion of the project. Management indicated that the company would approximately need an additional PKR 18 bn to complete the project (USD 63mn, USD 21/ton for adding 3mn tons as part of the machinery has already been purchased) and negotiations for some parts are ongoing.

The cooler retrofit is expected to increase the use of local coal from 20% of total consumption in FY23 to >40% and trials are being conducted at this point. This would lead to a reduction in cost if successful. The cooler retrofit is also expected to increase the company’s capacity from 6700TPD to 7500TPD and this project is expected to be completed within the current financial year.

The 10 MW solar power is expected to come online by the end of FY24. The estimated cost of this project is One billion rupees, and the Company plans to fund it from internal cash sources.

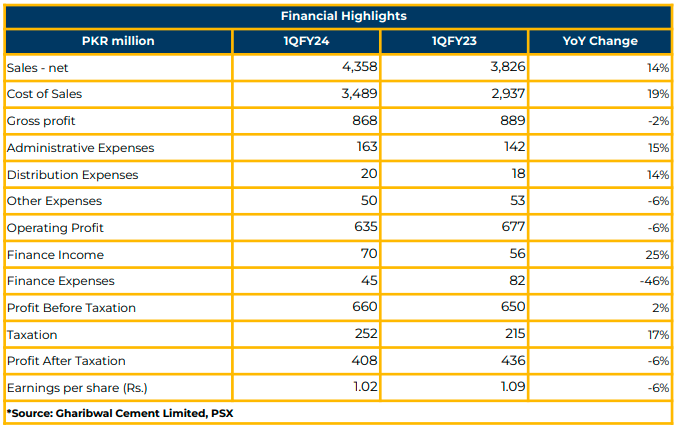

In 1QFY24, Gharibwal Cement Limited achieved a net profit of PKR 408.22 million (EPS: PKR 1.02), indicating a 6% YoY decrease from PKR 435.62 million (EPS: PKR 1.09) in the corresponding period of the previous year.

The Company’s revenue experienced a notable surge, reaching PKR 4.36 billion in 1QFY24, indicating substantial 14% YoY growth from the PKR 3.83 billion reported in the same period last year.

Cost of sales increased by 19% YoY to PKR 3.49 billion in 1QFY24 from PKR 2.94 billion in the prior year. In contrast, distribution expenses and administrative expenses increased by 14% YoY and 15% YoY to PKR 20.05 million and PKR 163.31 million, respectively, in 1QFY24.

Other expenses declined by 6% YoY to PKR 49.68 million in 1QFY24. Financial expenses decreased by 46% YoY to PKR 44.86 million in 1QFY24 as compared to PKR 82.48 million in SPLY.

GWLC reported dispatches at 1,349,789 tons in FY23, exhibiting a 19% YoY decline compared to 1,683,250 tons in SPLY due to reduced capacity utilization (61% in FY23 vs 76% in FY22). The current retention price of cement is PKR 15,000.

The net sales of the Company increased by 13% in FY23 to PKR 18.32 billion as compared to PKR 16.19 billion in SPLY. The increase was attributed to the rise in the average selling price per ton (41% up YoY). Financial expenses also witnessed a decrease of 55% YoY to PKR 72 million in FY23.

In FY23, net profit of GWLC decreased by 9% YoY to PKR 1.23 billion (EPS: PKR 3.08) as compared to PKR 1.36 billion (EPS: PKR 3.38) in SPLY.

The fuel mix of the Company is as follows: local coal (20%), Afghan Coal (58%), imported Coal (22%). The average coal cost was reported at PKR 48,000 per ton.

The power mix of GWLC was reported as follows: WHR & CFB (50%), National Grid (31%), HFO (19%). Management highlighted that the Company is not using gas for production due to higher costs and availability issues. Apart from this, the management shared that the limestone reserves are sufficient for fifty to sixty years.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.