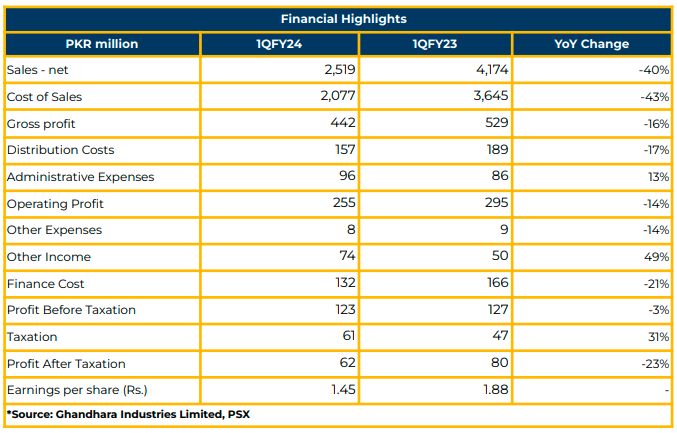

In 1QFY24, Ghandhara Industries Limited reported a net profitability of PKR 61.59 million (EPS: PKR 1.45), indicating a 23% YoY decline from PKR 79.94 million (EPS: PKR 1.88) in the corresponding period of the previous year.

The company’s top line dropped by 40% YoY, reaching PKR 2.52 billion, with a gross profit decline of 16%, amounting to PKR 442.37 million. Cost of sales also declined by 43% YoY to PKR 2.08 billion in 1QFY24 compared to PKR 3.64 billion in SPLY.

The distribution cost decreased by 17% YoY to PKR 157.26 million in 1QFY24 from PKR 188.71 million in SPLY, while administration expenses increased by 13% YoY to PKR 96.24 million during the same period.

The finance cost of the company decreased by 21% YoY to PKR 132.11 million in 1QFY24, compared to PKR 168.34 million in SPLY, due to higher interest rates.

In FY23, the management reported that the truck and bus market contracted by 41% YoY due to adverse macroeconomic conditions in the country. As a result, the net sales of the Company decreased to PKR 14.54 billion in FY23 compared to PKR 24.27 billion in SPLY.

In FY23, the profitability of GHNI decreased by 75% YoY to PKR 179.42 million as compared to PKR 728.5 million in SPLY. The finance cost of the Company also increased by 70% YoY to PKR 769.29 million during the same period.

The market share in trucks & buses was reported as: Hino (22%), ISUZU (42%), Master (32%), and JAC (4%) in FY23.

The segment-wise sales of the Company were reported as trucks (1,463 units), buses (137), and D-Max (194) in FY23. The total units sold were 1,794 in FY23. The Company plans to launch no new model in the upcoming year and aims to go green until 2030.

Ghandhara Industries experienced no significant decline in institutional sales in FY23, constituting 40% of the total sales of the Company. The other major revenue stream is from corporate and fleet customers.

The contribution of different series to sales revenue was reported as: N series (56%), F Series (21%), C Series (4%), D-Max (11%), and buses (7%).

The management shared that axle load implementation is likely to meet industry demand and can bring positive results if there are no import restrictions. Moreover, a more favorable and level-playing field can create increased demand for trucks in the country. Most of the trucks of GHNI are used for cargo purposes, as mentioned by the management.

Furthermore, the management aims to meet customer needs and initiate new projects. Moreover, the Company is working on inventory management to reduce the burden on working capital along with better utilization of resources.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.