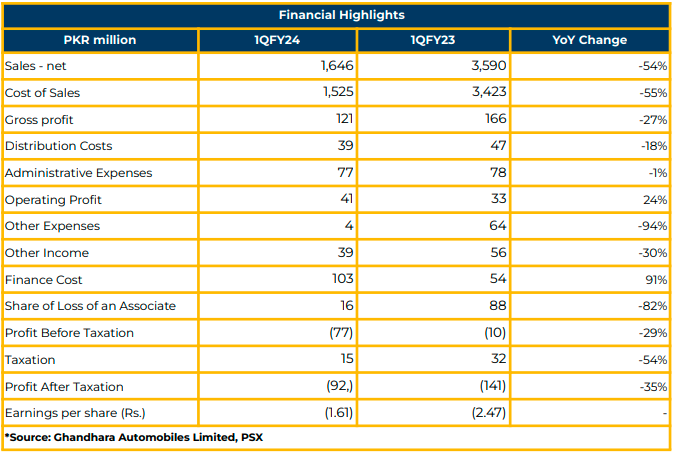

In 1QFY24, Ghandhara Automobiles Limited reported a net loss of PKR 92.02 million (LPS: PKR 1.61), marking a 35% YoY decline from PKR 140.75 million (LPS: PKR 2.47) in the corresponding period of the previous year.

The company’s top-line witnessed a 54% YoY decline, reaching PKR 1.65 billion, with a gross profit decrease of 27%, amounting to PKR 121.47 million in 1QFY24. The cost of sales dropped by 55% to PKR 1.53 billion in 1QFY24 from PKR 3.42 billion in the SPLY.

However, GAL’s finance cost increased by 91% YoY to PKR 103.15 million in 1QFY24 compared to PKR 53.89 million in SPLY. On the contrary, tax payments decreased by 54% YoY to PKR 14.81 million due to lower profitability.

The finance cost of the company rose by 22% YoY to PKR 429.35 million in 3QCY23, compared to PKR 352.64 million in SPLY, due to higher interest rates.

The company’s truck plant has a production capacity of 4,800 units per annum, assembling Dongfeng, JAC, and ISUZU commercial vehicles. Similarly, the car plant assembles Cherry SUVs and ISUZU DMAX pickups with a production capacity of 6,000 units per annum.

GAL launched Cherry car in FY22, well-received in the market, doubling the margins and net sales of the company in FY23. However, the entry of a new competitor introducing a hybrid model impacted the market share of Cherry car.

The company’s product portfolio includes heavy & medium-duty trucks (Dongfeng DFCV and Renault), light-duty trucks (Dongfeng DFAC and JAC), pickups (JAC), and SUVs (Cherry).

The company operates 26 distribution channels throughout Pakistan, with two regional offices located in both Islamabad and Lahore. In FY23, net sales and profitability were negatively impacted by exchange rate fluctuations, higher inflation and interest rates, and opening of LC restrictions.

In FY23, the sales volume of commercial vehicles remained under pressure: Hino (584 units), ISUZU (1,463 units), Master (971 units), and GNL & GDFPL (1,040 units). Likewise, the sales volume of passenger cars & SUVs declined significantly by 13% YoY in FY23. However, Cherry car sales for Tiggo (4) and Tiggo (8) significantly increased to 363 units and 909 units in FY23 compared to 51 units and 144 units respectively in FY22.

Consolidatedly, the net sales of GAL increased to PKR 13.10 billion in FY23 compared to PKR 6.38 billion in SPLY due to the higher sales volume of Cherry car. The gross profit margin remained flat at 9%.

The assets of the company consist of fixed assets (53%), inventories (32%), trade debts & advances (7%), and others (8%), funded by equity (61%), debt (22%), trade payables (13%), and others (4%).

Due to the development of the auto industry in China, the price gap is decreasing between Japan and China. However, it will take China at least two years to compete with Japan in the quality standards of auto industry.

The management criticized the government for devising unfavorable policies for the auto sector. On the implementation of the axle load policy, the

management is optimistic about its positive outcomes. The management stated that the import quota has been extended until the end of this calendar year.

Going forward, GAL aims to expand its dealership network in different cities of the country. Product diversification and optimum inventory management are also part of the efficient strategy.

Additionally, the management expects the sales volumes of Tiggo 8 to increase in FY24. After elections, the management anticipates an improvement in sales in the country.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.