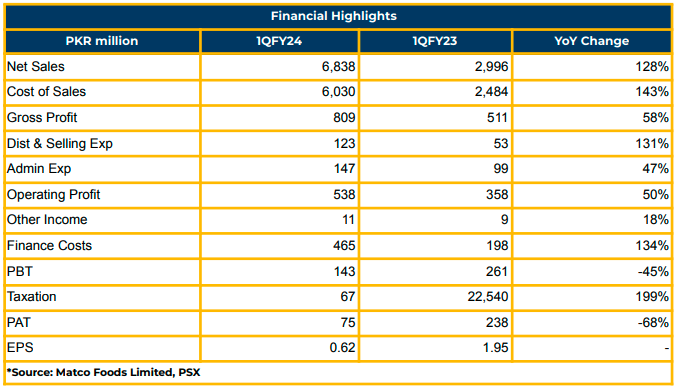

In 1QFY24, Matco Foods Limited witnessed a significant decline of 68% YoY in net profitability, reaching PKR 75 million (EPS: PKR 0.62) compared to PKR 238 million (EPS: PKR 1.95) in the same period last year. In FY23, MFL earned a net profit of PKR 555.62 million, an increase

from PKR 422.42 million the previous year.

The company’s revenue increased by 128% to PKR 6.84 billion in 1QFY24, up from PKR 2.99 billion the previous year, driven by higher prices. However, exports declined due to unattractive prices in the international market. In FY23, MFL reported sales of PKR 19.99 billion with a gross profit of PKR 2.45 billion.

Gross profit rose by 58% to PKR 809 million, compared to PKR 511 million the previous year. Distribution expenses increased by 131% to PKR 123 million, and administrative expenses rose by 47% to PKR 147 million in 1QFY24. Finance costs increased by 134% to PKR 465 million in 1QFY24 from PKR 198 million in 1QFY23.

MFL’s business segments include Matco Foods Limited, Rice Glucose Division, Matco Foods Corn Division, and Falak Foods.

In FY23, the industry sales of Rice Basmati declined by 21% YoY, while MFL’s rice sales declined by 22%. The prices of Basmati rice remained attractive, but demand showed a declining trend. Similarly, the export prices for Irri Rice remained unfavorable, making the local market more attractive for the company.

The decline in profitability in FY23 was attributed to devastating floods, which affected the rice-cultivated area, reducing it by 16%, and production was reduced by 21%.

Falak Food division experienced a 172% YoY decrease in sales to PKR 136 million in FY23 from PKR 402 million in FY22. The company aims to launch two new products in a year in the Falak Food division. Local and export sales of Falak Food were reported at PKR 349 million and PKR

53 million, respectively, in FY23.

The Rice Glucose Division experienced a significant decline in exports due to lower demand. Additionally, raw material prices significantly increased, offset by increased demand from confectionery, pharmaceuticals, and poultry sectors. Local and export sales were reported at PKR 1.48 billion and PKR 1.36 billion, respectively.

The Corn Starch division started production in August 2022. Local and export sales were reported at PKR 1.87

billion and PKR 405 million in FY23.

The Dextrose Monohydrate Project is expected to be completed by next month. India’s ban on rice exports is also expected to boost the company’s rice exports. The management also anticipates volumetric growth due to the rice season in upcoming quarter.

Going forward, the management aims to expand its presence in Europe and the Middle East for rice processing business and branded rice. Moreover, MFL anticipates introducing new products, increasing grind capacity, and expanding the range of starch products.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.