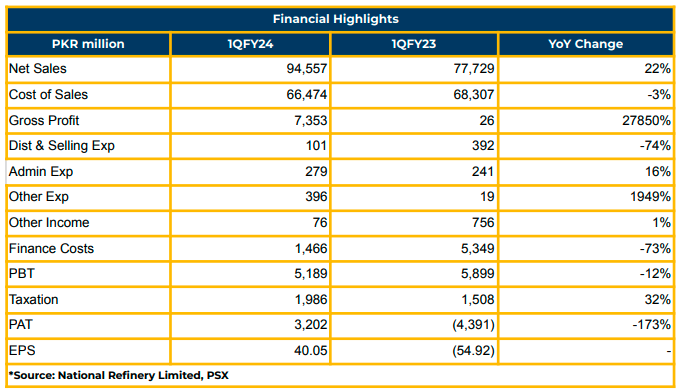

In 1QFY24, National Refinery Limited demonstrated significant growth in net profits, reaching PKR 3.20 billion (EPS: PKR 40.05), a substantial rise from the previous year’s net loss of PKR 4.39 billion (LPS: PKR 54.92).

The fuel segment earned PKR 1.99 billion in 1QFY24 compared to a loss of PKR 4.46 billion during the same period last year. This improvement was driven by consistent growth in gross profit margins due to increased petroleum product prices. The GRM for the fuel segment stood at $10.95/bbl in 1QFY24, compared to $2.49/bbl in SPLY.

In contrast, the lube segment earned a net profit of PKR 1.21 billion in 1QFY24 compared to PKR 66 million in SPLY. The GRM for the lube segment was reported at $17.28/bbl in 1QFY24, up from $10.60/bbl in SPLY.Additionally, the company reported an exchange gain of PKR 367 million due to effective exchange rate policies and strict border control measures.

Management stated the production of Very Low Sulfur Furnace Oil (VLSFO) has commenced. Additionally, they are considering the installation of Continuous Catalyst Regeneration (CCR) units to increase oil production. The project cost was estimated at USD 250-300 million.

The crude oil refinery capacity is 23.1 million bbl per annum. The crude oil payment cycle was reported at thirty days. The Company has decided not to import Russian Oil, considering it unprofitable.

In FY23, the nation utilized 2.2 million tons of domestic MS and imported 5.3 million tons. HSD consumption amounted to 3.8 million tons, with 2.5 million tons imported. Local FO consumption reached 1.6 million tons, while 1 million tons were imported, indicating the country’s diverse fuel consumption patterns.

NRL’s share reduced to 11% in domestic production in FY23, with a production mix comprising 32% HSD and 15% Furnace Oil.

In FY23, gross refinery margins declined to PKR 26.47 billion from PKR 35.06 billion. Finance costs increased to PKR 16.25 billion. However, in 1QFY24, gross refinery margins improved to PKR 11.48 billion from PKR 3.24 billion in SPLY. Finance costs decreased to PKR 1.47 billion compared to PKR 5.35 billion in SPLY.

The management completed the feasibility study of the hydrocracker plant, finding it unfeasible. The Company is exploring alternatives to reduce furnace oil production and convert it into value-added products.

Going forward, the Company anticipates potential impacts from volatile crude oil prices and exchange rates on profitability. Higher inflation is also expected to affect the cost of operations, and the country’s economic stability is a major concern. Moreover, the opening of joint escrow accounts to upgrade projects under brownfield refinery policy is set to be signed by November 16, 2023.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.